Content

The height is then transposed on the pattern’s resistance. There is no definite technique to predict how much the price of the security will goes up. Others techniques of the technical analysis should be employed to predict what does a falling wedge indicate the target price. The breaks of the upper resistance indicates that the buyers are taking control and the forces of demand won. In a rising wedge, both trendlines rise from left to right, and in the falling wedge fall.

Usually, the estimated profit target is the thickest part of the wedge. The rectangle at the beginning of the wedge represents the estimated target profit margin. This pattern works as both a trend reversal and trend continuation pattern. From beginners to experts, all traders need to know a wide range of technical terms. Draw the support level at the base of the triangle and resistance level at the peak of the triangle converging towards the single point known as apex.

Download Our FREE Ebook of Supply & Demand Trading

But it is very small at just 51.4% versus 48.6% the other way. Test yourself with our interactive forex trading patterns quiz. This type of pattern appears during the correction in a bullish movement, it is a bullish continuation pattern. The breakout can occur when the two lines converge around the apex point.

A right-angled rising triangle is formed by two diverging lines, with the assistance being a horizontal line and the resistance being an oblique bullish line. Widening kinds, unlike many other consolidation patterns, have progressively vast arrays and are susceptible to substantially higher levels of volatility as time goes on. An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline.

- On major forex pairs the falling wedge has correctly predicted the resumption of a bullish trend with odds that are slightly better than chance alone.

- If the descending broadening wedge formation emerges in a downtrend, then the trend will reverse.

- These are signs that purchasing pressures have been reduced to profit-taking.

- Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years.

In this pattern, both the support and resistance lines are rising lines as the formation develops. And it only completes if one large or two medium-sized candles close below the resistance line. You must know the risks and be willing to accept them to invest in the securities markets.

quiz: Understanding rising wedge

Make sure to add spread while adjusting the stop loss level. If Price break the trend line without touching resistance or supply level, then it can be a false breakout to trap retail traders. These patterns indicate bears losing momentum as they appear in a swing low.

Because there are many chances of reversal from a key level. Although it is a Bullish pattern, you can notice the occurring of the pattern in both upward and downward trend. To be seen as a reversal pattern it has to be a part of a trend to reverse. In a perfect world, the falling wedge would form after an extended downturn to mark the final low.

The downward slope of the resistance line can look exactly like the downward slope of the resistance line of a descending triangle. However, the bottom support trend line of a descending triangle is horizontal, not sloped like that of a falling wedge. The pattern is generally considered bullish and can be a market continuation or reversal pattern. The wedge represents a narrowing or consolidation of the price before a break to the upside. The descending broadening wedge consists of 2 non-parallel pattern lines that are moving downwards. This is particularly true if you spot a falling wedge that doesn’t follow an uptrend, which is rarer but can arise.

What Is a Falling Wedge Pattern & How to Identify These Patterns?

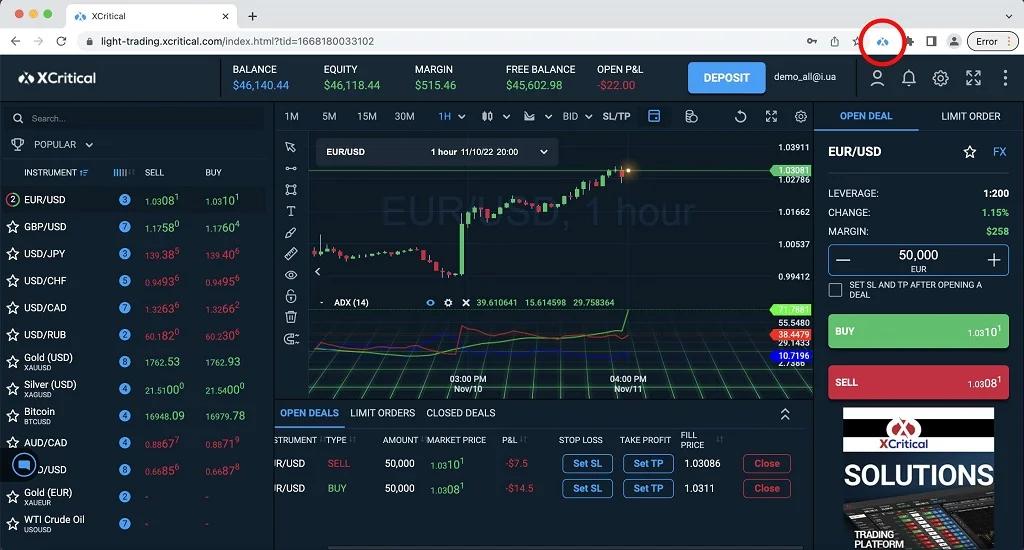

Alternatively, you can practise trading wedges with a cost-freeFOREX.com demo account. You’ll get full access to our platform, preloaded with virtual funds. So, you can test out your wedge trading strategy with zero risk. It may take you some time to identify a falling wedge that fulfills all three elements.

On the monthly chart, you can see a falling wedge, and all patterns should be retested. This is a chance to retest the wedge on the breakout point at 61.76 or even lower at the trendline. … the entry is placed when either the price breaks above the top side of the wedge, or when the price finds support at the upper trend line. The falling wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. This lesson shows you how to identify the pattern and how you can use it to look for possible buying opportunities. It is a bullish reversal pattern which appears in the swing low of downtrends.

This is why we’d always recommend setting a stop loss when you open your position. Finally, you have to set your take profit order, which is calculated by measuring the distance between the two converging lines when the pattern is formed. This way we got the green vertical line, which is then added to the point where the breakout occured.

quiz: Understanding Crab pattern

If you find a falling wedge reversal pattern after a considerable price downturn, consider it more profitable. It is difficult to predict whether the bearish trends will reverse or continue. Therefore, finding the falling wedge reversal pattern at the bottom increases the probability of trend reversal. Alternatively, you can utilize the prospective resistance location to forecast the target cost .

However, the next day the price opened even below the opening of that day, confirming the reversal of the pattern. One of the time tested and true ways to trade on a candlestick chart is continuation patterns. This causes bulls to abandon their positions and the rate of their selling increases due to the speed of the drop in price. Then, this draws in new traders who have wanted to short but were waiting for some critical level or levels to break. Even if you see falling volume, a green confirmation candle and check a momentum indicator before trading, there’s still the chance for the trend to fail when trading wedges.

For this reason, you might want to consider using the latest MetaTrader 5 trading platform, which you can access here. Deepen your knowledge of technical analysis indicators and hone your skills as a trader. Fallingwedgepatterns may look like triangles or pennants.

Watch our video on how to identify and trade falling wedge patterns. Technical indicators and price chart patterns are essential to technical analysis and price predictions. Still, they must be applied correctly and in optimized combinations and conditions to maximize their success rate. The falling wedge pattern is a bullish trend reversal chart pattern that signals the end of the previous trend and the beginning of an upward trend. When ascending broadening wedge formation appears in the downtrend, this means that there is a continuation of the previous trend. When ascending broadening wedge formation appears in the uptrend, this means that there is a reversal of the previous trend.

quiz: Understanding Three drives pattern

Day Trading is a high risk activity and can result in the loss of your entire investment. When I trade triangle patterns, I like to wait for the break of the second to last swing high or on the retest of the breakout. I have never been a big fan of trading the breakout of a triangle on a candlestick chart.

Trading Advantages for Wedge Patterns

When the falling wedge appears in an uptrend, this signals the continuation of the previous trend . It provides crypto traders with opportunities to take long positions or average their position in the forex market. The price objective is determined by the highest point at which the descending broadening wedge was formed. On the other hand, when falling wedges do finally break the pattern, they tend to accelerate at a faster speed than other patterns.

Key levels

However, unlike other patterns where the breakout rate is fixed, a falling wedge breakout rate is variable, depending on the time of the breakout. As a result, pre-breakout calculations are limited to pattern length and second stop loss. The range of results in these three https://xcritical.com/ studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy.

In other words, when a wedge rises it predicts a downtrend, and when it falls, it predicts an uptrend. On the hourly chart , there was less variation but the odds were slightly less favorable than on the four hour chart. The odds of a bullish continuation following a falling wedge were 51.7% on the hourly chart. The ones that appeared in bearish trends or flat markets were ignored. The trend was measured as the slope of the simple moving average (SMA-100) using a simple 10 point box filter.

Typically, traders will wait to confirm the uptrend before executing their order. The simplest way to do this is to wait for the next candlestick after the breakout. A stop-loss order should be placed within the wedge, near the upper line.

Target – There is no specific target in this pattern, most traders enjoy the profit by applying trailing stoploss. The limitation for the target will be last three resistance level which was formed before by the price action. However, in triangles, both trendlines do not have the same direction. In a symmetrical triangle, the support trendline rises from left to right while its resistance trendline falls. In an ascending triangle, the upper line of the pattern is flat, and the support line is rising. In a falling triangle, the support line of the formation is flat, and its resistance descends from the right to the left.